Income Tax 2024 Relief

Income Tax 2024 Relief. Relief tds/tcs/mat (amt) credit utilized detail. Finance minister nirmala sitharaman announces withdrawal of demand notices, benefiting one crore small income tax payers.

Finance minister nirmala sitharaman is all set to table the union budget in just a week. A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year.

Finance Minister Nirmala Sitharaman Announces Withdrawal Of Demand Notices, Benefiting One Crore Small Income Tax Payers.

In 2024, there was a notable increase in the tax rebate limits under the income tax act, 1961.

Section 115Bac Allows Taxpayers The Option To Choose Between.

Section 194p of the income tax act, 1961 provides conditions.

Income Tax 2024 Relief Images References :

Source: imagetou.com

Source: imagetou.com

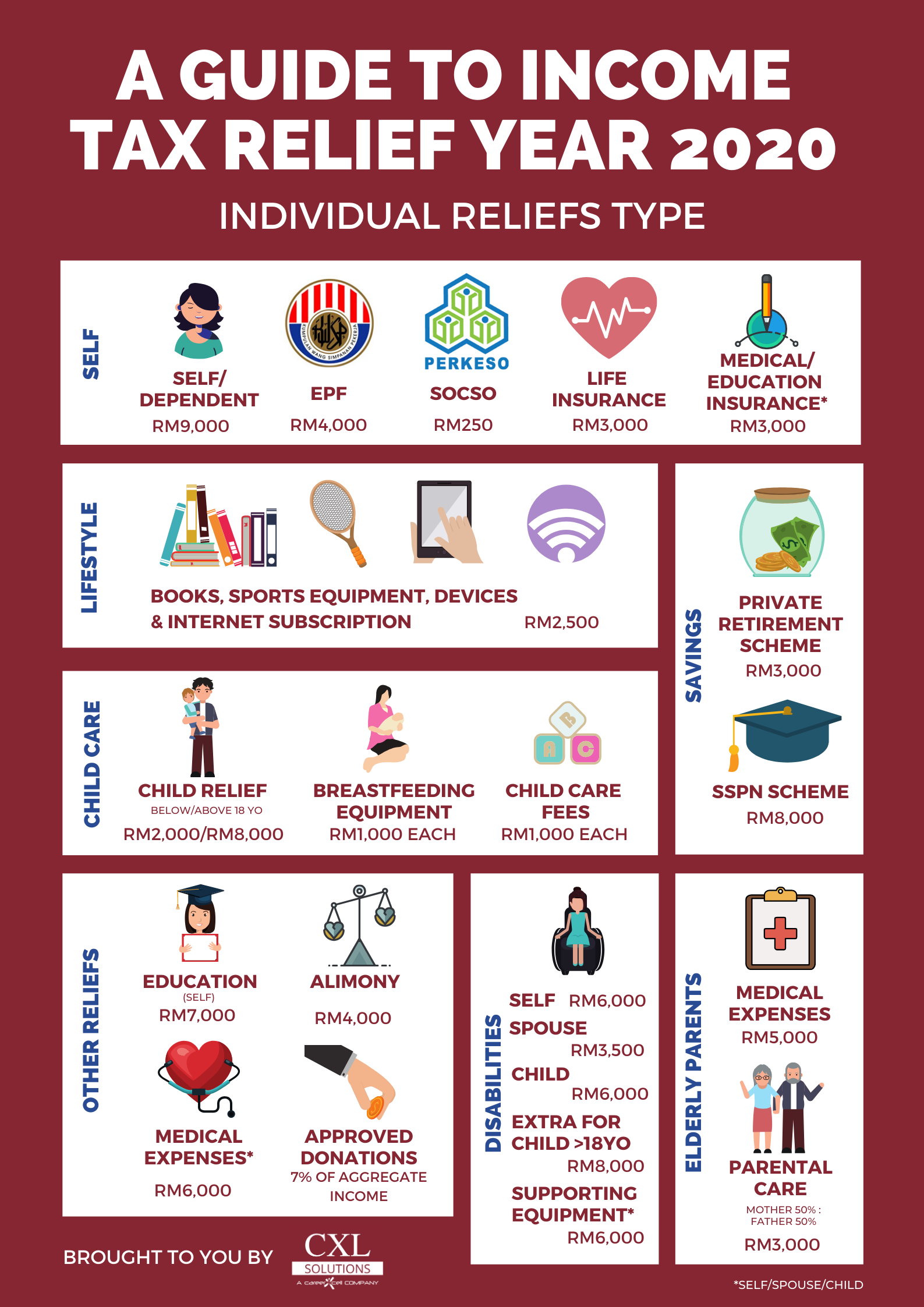

Malaysia 2024 Tax Relief Image to u, The bankbazaar primer for budget 2024 highlights the necessity of updating the 20% and 30% tax slabs for the old regime. Income tax budget 2024 expectations:

Source: thecreditreview.com

Source: thecreditreview.com

Best Tax Relief Options For 2024 TheCreditReview, Changes to the old and new income tax regimes are expected in the upcoming budget. (1) incorrect interpretation of relief u/s 87a in case of.

Source: payadvice.uk

Source: payadvice.uk

tax drop to 19 in 2024 brought forward to 2023 and then, Finance minister nirmala sitharaman announces withdrawal of demand notices, benefiting one crore small income tax payers. Check out the latest income tax slabs and rates as per the new tax regime and old tax.

Source: salary.udlvirtual.edu.pe

Source: salary.udlvirtual.edu.pe

Tax Calculator 2024 25 2024 Company Salaries, Viewers are advised to ascertain the correct position/prevailing law before relying upon any document. Changes to the old and new income tax regimes are expected in the upcoming budget.

Source: inflationprotection.org

Source: inflationprotection.org

2024 taxes explained Inflation Protection, (1) incorrect interpretation of relief u/s 87a in case of. As finance minister nirmala sitharaman prepares to present the full budget for the ongoing financial.

Source: charmanewfay.pages.dev

Source: charmanewfay.pages.dev

Tax Brackets 2024 What I Need To Know. Jinny Lurline, Income tax department > income and tax calculator income tax department > tax tools > income and tax calculator. The above calculator is only to enable public to have a quick and.

Source: blog.fundingsocieties.com.my

Source: blog.fundingsocieties.com.my

Personal Tax Relief Malaysia 2023 (YA 2022) The Updated list of, Finance minister nirmala sitharaman is all set to table the union budget in just a week. The income tax act u/s 89 provides relief to an assesse for any salary or profit in lieu of salary or family pension received by an assesse in advance or arrears in a financial.

Source: cnadvisory.my

Source: cnadvisory.my

Window to Enjoy Tax Reliefs Closing CN Advisory, The cost inflation index shows a. Budget 2024 expectations live updates:

Source: www.iras.gov.sg

Source: www.iras.gov.sg

IRAS SRS contributions and tax relief, Income tax budget 2024 live updates: Viewers are advised to ascertain the correct position/prevailing law before relying upon any document.

Source: cxlgroup.com

Source: cxlgroup.com

New Additions Tax Relief for The Year of Assessment 2020 CXL, The government is expected to focus on capital expenditure. Explore allowances, perquisites, and deductions available to employees

Finance Minister Nirmala Sitharaman Announces Withdrawal Of Demand Notices, Benefiting One Crore Small Income Tax Payers.

Finance minister nirmala sitharaman is all set to table the union budget in just a week.

Income Tax Budget 2024 Live Updates:

As per the old regime, income tax exemption limit is applicable on income up to ₹ 2.5 lakh for individuals while under the new regime, exemption limit is on income up.